HSBC Payme and BOC Pay have announced to participate in the second phase of the consumption voucher scheme this year, citizens may switch to one of the other 6 platforms before the distribution date of the consumption voucher. We have published an article about the AARRR strategy adopted by the first four e-payment platforms, which discussed how can we grab every chance to attract new customers and retain the existing ones. In this article, we will focus on the whole local e-payment market and talk about how did the consumption voucher scheme of these 2 years make huge progress in the cashless society development.

As an international financial center, there are various mature payment tools in Hong Kong. Even 20 years ago, Hong Kong citizens were already using Octopus to take public transport, pay for lunch, or for shopping; If we ran out of cash, we can also use EPS to pay and withdraw money from our bank account; PPS helps us to pay our bills at home… the list of the payment methods in Hong Kong goes on and on. Hong Kong was already halfway through becoming a cashless society when the term hasn’t even existed at the time. However, as a pioneer city of e-payment development, Hong Kong is still facing a lot of difficulties when promoting mobile payment.

Perhaps due to the habit of using mobile payments before the consumption voucher scheme, citizens are not quite interested in using mobile payments or e-wallets. Meanwhile, the Hong Kong government would like to catch up with Mainland China in terms of the development of e-payment, so as to follow the worldwide cashless society bandwagon. For these two years, the government launched the consumption scheme in the form of e-vouchers, hoping to increase the usage of mobile wallets in Hong Kong, as well as expand the network of mobile payments among businesses.

So, how did it go?

Without a doubt, for the payment platforms providers, the voucher scheme is a great opportunity to expand its existing customer base and business partners, so as to increase the usage and expand the coverage of verified partners of their platforms. Therefore, there are different kinds of welcoming rewards offered by different platforms. An obvious example would be Payme and BoC Pay, as newcomers, they provide new users with rewards for joining (or switching to) their platforms, lucky draw, exclusive rewards for consumption vouchers, friend recommending rewards, and so on. The rewards are very tempting, as they are trying to win as many new customers as they can in this competition of voucher scheme. Last year’s figures have shown that almost 3 million new accounts of the original 4 payment service providers had been signed up, which is almost half Hong Kong’s population and we can see that the voucher scheme made a ginormous impact on the e-payment industry.

According to the research done by Lingnan University, The factors affecting respondents’ behaviors in choosing payment methods are special offers (27%), the habit of usage (25%), and the coverage and accessibility of the mobile payment methods (24%). We can see that even though the service providers can successfully attract new customers, without performing well in the mentioned aspects, the platforms are still less likely to retain their customers.

You might have already found out, that the amount of merchants accepting e-payment has already increased throughout the years regardless of offline or online purchases, big brands, or small businesses. Looking back to the above data, the voucher scheme last year helped the platforms to gain around 80 thousand newly registered merchants. Not only can the platforms gain a huge amount of B2C personal clients, but they can also increase their negotiating power when it comes to hardware assistance and installation fees. The platform providers may as well provide offers to the merchants and cover the costs with the profits made from the personal clients in this voucher scheme, so as to attract more small-and-medium enterprises to adapt their services.

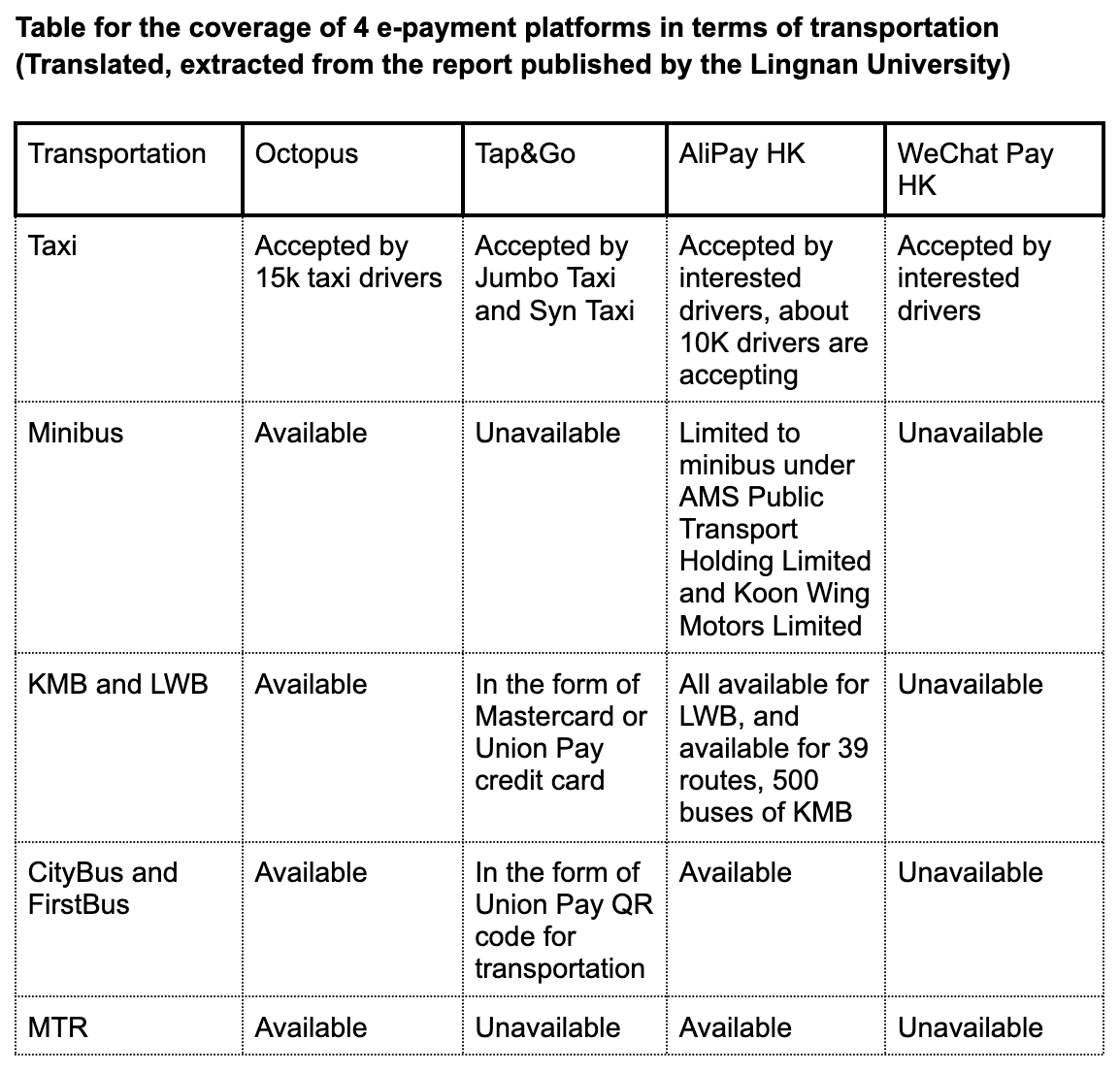

Apart from the increase in quantity, the quality of e-payment services is also enhanced. To gain as many sales as possible, merchants would put in efforts to utilize these e-payment tools, combining them with their POS, and provide the most convenient payment experience to the customers. Take Octopus as an example, originally, we can only use Octopus to take public transport or make small-amount purchases, but now we may use it in wet markets, online shopping, or even buying furniture and appliances. We can see that the voucher scheme has subverted our imagination with what we can do with Octopus. Apart from that, the payment method for transportation is not limited to Octopus or coins anymore, buses and the MTR started to accept Alipay, UnionPay, credit or debit cards, and NFC payment already.

Externally, the complete facility and installation of local mobile payment expanded the coverage of mobile payment. Internally, different payment platforms continue to improve their services, making their mobile wallets the tools for shipping payment, bill payment, P2P transferral tools, voucher acquiring platforms, and even currency exchange service providers. As users, we are surely benefited from this healthy competition. Not only can we enjoy different kinds of rewards and offers, but more maturely-developed mobile payment methods. If you are interested in the case studies and insights that we have shared, feel free to browse more from our website.