The sixth Hong Kong Fintech Week has successfully ended this month. With the advance of technology, Fintech (Financial Technology) has been slowly emerging into our lives. Fintech is involved with a lot of aspects, such as cryptocurrency, electronic payment, to virtual banks.

Virtual bank is a new kind of banking service. 8 different virtual banks have started to put in services one after another since the Monetary Authority issued the official virtual bank licenses in 2019. The gimmick of virtual banks is that they do not have a physical bank, all the banking services will be processed online. Such an act saved enormous operation costs considering the high rent rate in Hong Kong. However, as for the clients, they might not be confident enough about the bank to open an account and put their savings in it because they cannot visit the bank physically. The trust level and reputation of virtual banks take time to build up. Therefore, the virtual banks spent their saved operation costs on returning to their customers, providing attractive rate offers and cashback, so as to boost their account registration. Now, the virtual banks successfully paved a new path in the banking industry in Hong Kong, effectively acquiring and retaining their active customers.

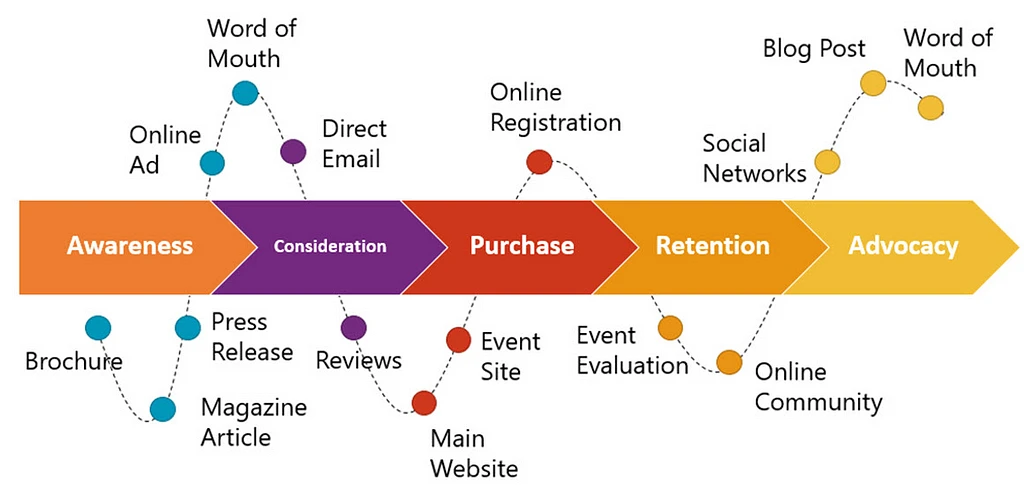

This article will apply the concept of the customer life cycle to discuss the marketing strategies of 4 virtual banks, including ZA bank, WeLab bank, livi bank, and Mox bank.

Awareness and Consideration

Advertising is a timely promotion strategy to let potential customers know about the existence and speciality of a product or a company. Apart from the collaboration with celebrities on advertisements, the virtual banks also provide sufficient incentives to attract users to set up accounts and use their services. Hence, all virtual banks carried out welcoming offers to new users.

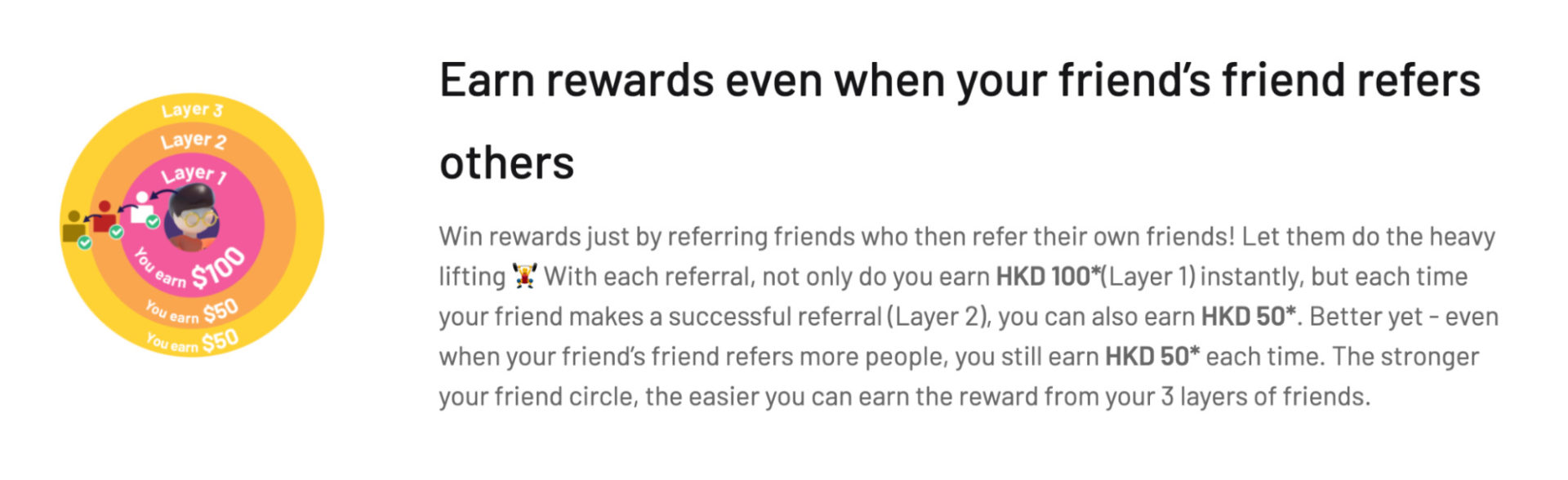

New users may receive welcoming offers by inputting invitation codes while registering. If they are using the invitation code of their friends, they can claim the rewards together. The reward scheme encourages existing customers to invite new users actively, the new users will then invite other new users afterward. With such a snowball effect, more and more new users will start using the virtual bank service.

WeLab bank has the most attractive referral scheme. users can earn rewards by referring their friends to open accounts. When the referrer’s friends referred other new users, the first referrer can also earn rewards from his friends’ friend, until the reward amount reached HK$5000. Or like Mox bank, the more friends a user can refer, the referral offer amount will increase over time.

Of course, there is no free lunch in this world, neither in the virtual banks. At first, the welcoming cash rewards will be saved in users’ accounts immediately, but to prevent users from discarding accounts after claiming the rewards, the virtual banks set up more rules to constrain the users: Users must compete for at least one transaction after setting up an account. Such an act is able to let users experience the transaction function of virtual banks, and prevent the abuse of welcoming offers at the same time. Virtual banks are running businesses after all, no one would spend a high cost on a business that does not bring any income to the company.

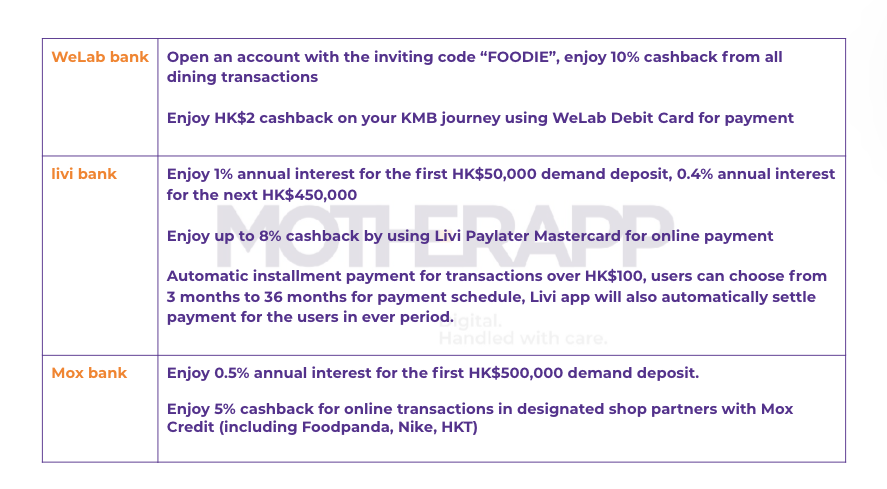

Purchase

Many citizens own traditional bank accounts, it is not a must for them to use or switch to virtual bank services. Attracting users to open an account is only the first step. To attract more users to try or actually start using the saving and transactional services of the virtual banks, the virtual banks came up with different cashback, credit, or saving rate offers. The offers covered a variety of products and services, and are more attractive compared to those of traditional banks. The examples include:

Retention and Advocacy

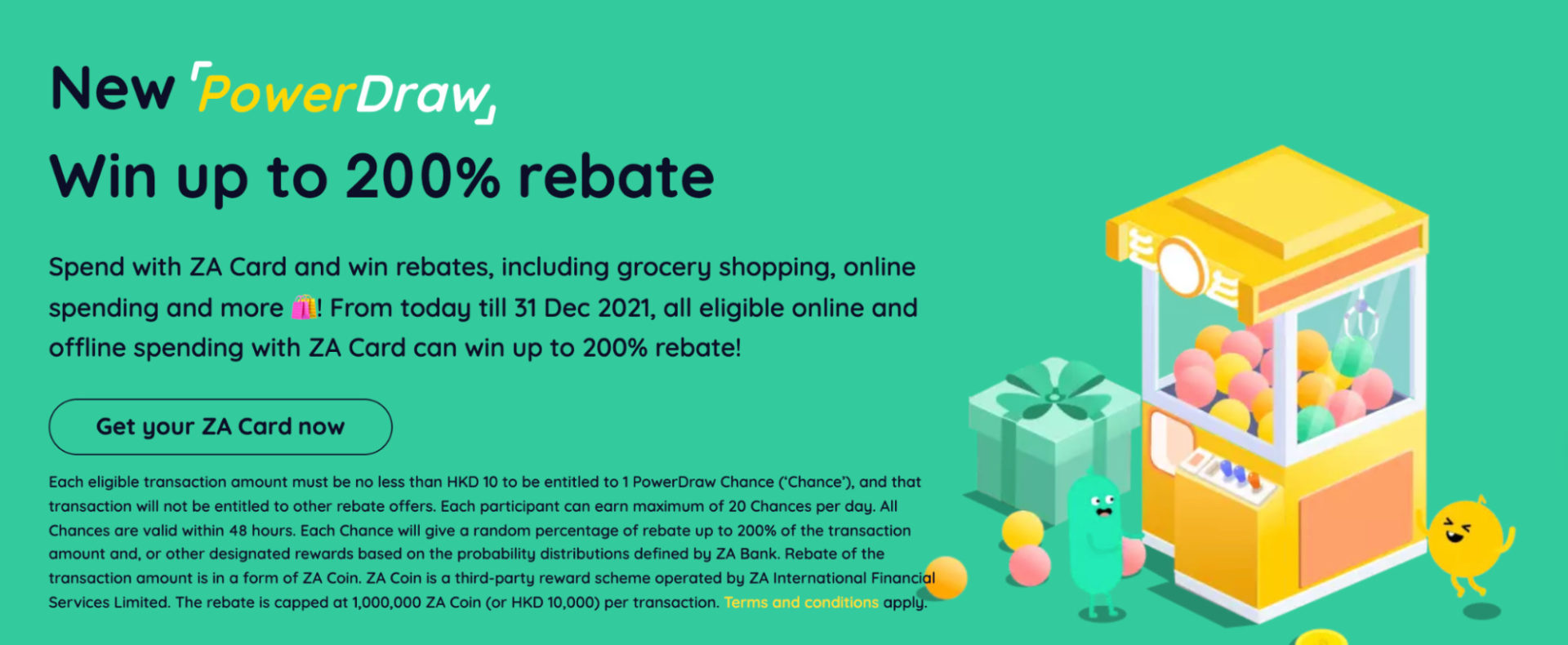

For a bank, it is better if there are more active customers. To raise the customers’ interest in the bank, ZA bank applied gamification in their application, encouraging customers to make transactions with mini-games, enhancing user experience and engagement. For example:

“Power Draw”

After every eligible transaction, the system will use the claw machine animation to draw the cashback percentage that the customer received this time, the maximum amount of cashback is 200%. A lucky draw function makes the process of providing cashback rewards more exciting and attractive. Users might continue to use ZA bank for payment just to claim that 200% of cash rewards.

Monthly Quests

ZA bank set some of its functions and transaction goals as monthly quests for the users. Every time the user finished a mission, they may enjoy a chance for using the capsule toy machine and acquire a random amount of ZA coins, which can be transferred to cash directly. Apart from that, users can also experience the functions and services of ZA bank while doing the quests, such as transferring money to a ZA bank account from the traditional bank account or making payments with a ZA bank card.

These gamification elements made ZA stand out from the virtual bank industry and acquire customer loyalty. A lot of users got used to using ZA bank as their payment method or banking platform and became active users because of the monthly quests and the lucky draws. These users will also refer their friends and family to ZA bank and start a new round of the customer life cycle.

Conclusion

From the above examples, loyalty programs and quantitative trading has been expanding from the traditional retail industry to different industries. As a loyalty program technology developer, we developed our unique loyalty assisting engine called Aillia, which can help you to emerge digital loyalty program and CRM strategies into your business. If you have any needs or are interested, do not hesitate to contact us for more information.