With technological advancement, the pandemic, and the changes in customer behavior, contactless payment keeps growing all around the world. From credit cards, virtual wallets, to NFC payment, the functions of the e-payment platforms keep on updating. As of today, the digital wallet may even accept transactions of cryptocurrency. Digital payments are being widely accepted in online shopping, physical transactions, even in transportation.

Contactless payment is fast and convenient, all the customers need to do is to tab their phones on the sensors and finish the payment, without the trouble of giving changes and signing the receipts. Especially during the pandemic, contactless payment may avoid unnecessary physical contacts between the salesperson and the customer, so that the infection risk will be reduced.

Last year, because of the consumption voucher scheme, a lot of small businesses have installed equipment for contactless payment, such as NFC and Octopus sensors, as well as setting up the business accounts on digital payment platforms. The voucher scheme has boosted the usage of electronic payment, and the development of cashless transactions.

In the Hong Kong budget speech of 2022, the government announced that there will be another round of consumption voucher scheme this year delivering $10000 to the citizens. The first $5000 will be stored in the registered account from last year.

We have published an article about the CRM strategies of e-payment platforms. In this article, let’s take a look at the updates and new technologies of the electronic payment platforms.

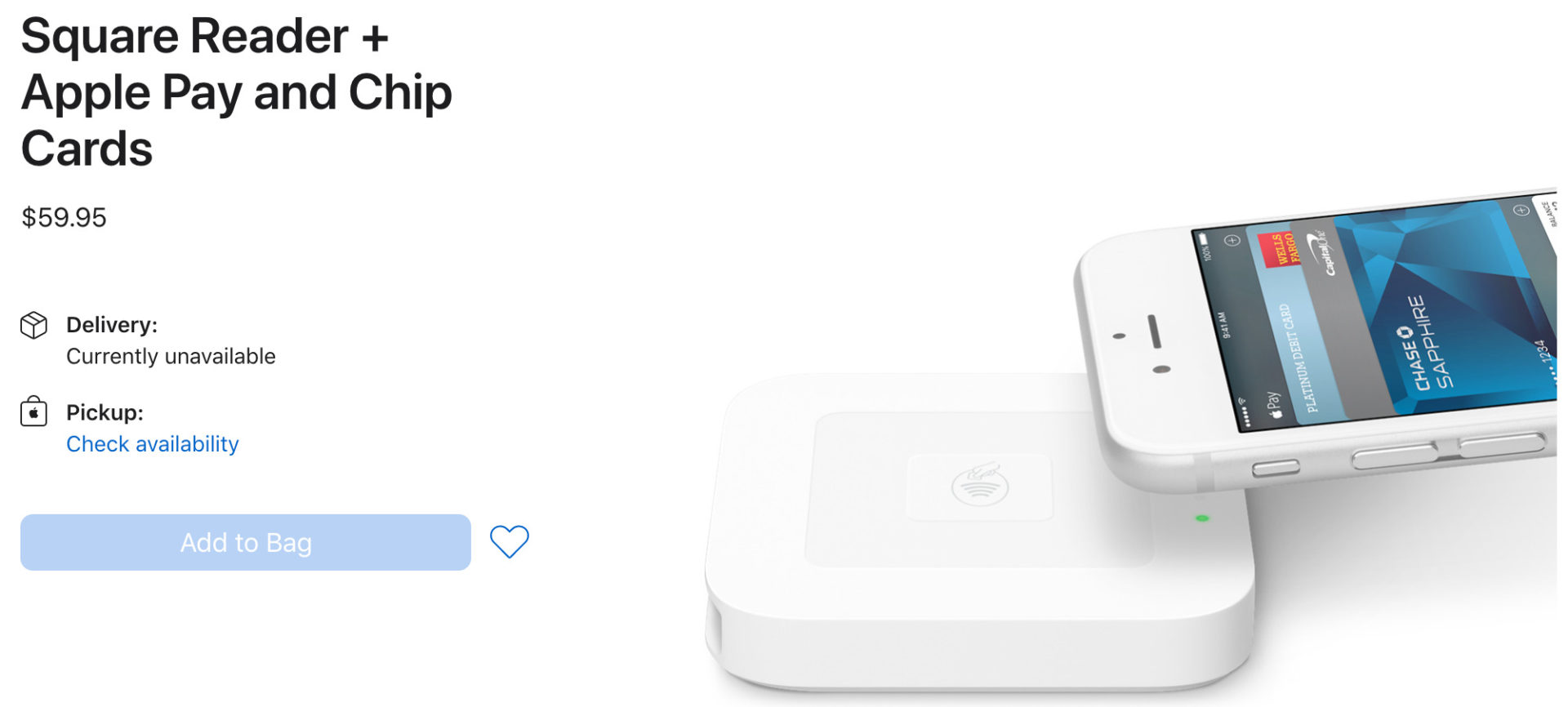

Apple, the giant of the smartphone market, is praised for its very own payment service. Apple Pay is loved by the users because it is convenient and secure. iPhone users only need to link their credit cards with their Apple wallet if they want to use it in online or offline transactions with their phones. Apple Pay can also be used in different devices and it is very convenient for the Apple fans.

However, because of the high costs of installation, Apple Pay is seldom accepted by small businesses. Hence, Apple has pilotly launched their Tap To Pay service in the US region, allowing businesses to use iPhone directly as their NFC sensors for receiving contactless payment. Businesses do not have to rely on the additional POS anymore and the cost for having contactless payment can be reduced. It is believed that in the future, buyers and sellers can make cashless transactions anywhere as long as they have a smartphone on their hands.

It is obvious that e-commerce is a new trend for retailers, a lot of online loyalty programs and online shopping platforms are launched to combine the physical and virtual membership information, so as to further enhance the O2O shopping experience of customers. It is important yet expensive to synchronize the online and offline loyalty points status, product information, inventory availability, and shopping procedure since a combined POS and CRM systems are required.

Except for NFC payment, Apple allows businesses to launch their membership programs on Apple Pay so that the users may add their membership cards into their Apple wallet for redeeming points. It is even more convenient for the customers to redeem points offline with the new Tap To Pay function, the POS and CRM system can also be combined in an easy, effective, and cost-efficient way. For businesses and customers, a smooth and fluent purchase procedure enhanced the shopping experience. As for Apple, a completed and user-friendly payment function attracted more users for Apple Pay, so that the service networks and market shares can be enhanced, creating a three-win situation.